IU Residents

Basic Group Life and AD&D Insurance

Overview

Indiana University provides Basic Group Life and Accidental Death & Dismemberment (AD&D) Insurance to all full-time Medical and Optometry Residents at no cost. Eligible Residents are automatically enrolled in the plan, with coverage effective as of the date they become eligible (typically date of hire). This plan is underwritten by Standard Insurance Company (“The Standard”). The group policy number 135262-G.

Resources

Plan Benefits

This following list is a summary of benefits. For full plan details, review the IU Resident Basic Group Life and AD&D Certificate.

- Basic Life: This term life policy pays a benefit of $20,000 in the event of an eligible member’s covered death (benefit amount reduces beginning at age 65).

- Accidental Death & Dismemberment (AD&D): The AD&D benefit pays up to an additional $20,000 in the event of a covered accidental loss of life (benefit amount reduces beginning at age 65). For other covered losses, a percentage of this benefit will be payable.

- Accelerated Benefit: The accelerated benefit pays up to 75% of the Basic Life benefit amount to the Resident in one lump sum if the Resident has a terminal illness with a life expectancy of 12 months or less.

Other Plan Features

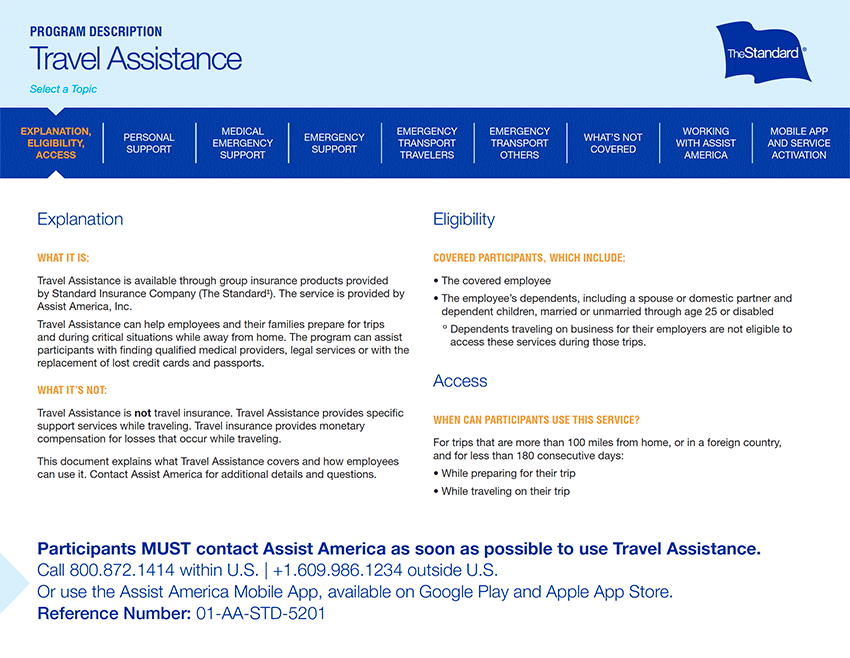

Travel Assistance by Assist America

Assist America is a comprehensive program of information, referral, assistance, transportation, and evacuation services designed to help you respond to medical problems or other emergencies that may arise during travel. Assist America also offers pre-travel assistance, which gives you access to information on things like passport and visa requirements, foreign currency, and worldwide weather. Services are available when you and eligible family members (spouse and children through age 25) travel more than 100 miles from home or internationally for up to 180 days for business or pleasure.

Download the Mobile App

- Visit Google Play or the Apple App Store

- Enter reference number 01-AA-STD-5201 and member name

Receive Services 24/7

- Use the Tap for Help button on the mobile app

- Call 1-800-872-1414 within the U.S.

- Call 1-609-986-1234 outside the U.S.

Life Services Toolkit

The Standard has partnered with Health Advocate to provide online tools and services that can help you and your beneficiaries plan and prepare finances in the event of death. Services include:

- Estate Planning Assistance

- Financial Planning

- Funeral Arrangements

- Legal Services

To get started go to the Life Services Toolkit (Username = support) or call 1-800-378-5742.

Filing a Claim for Benefits

Residents and beneficiaries may file a claim for benefits by following the instructions below. Be sure to read the form instructions carefully to ensure the appropriate supporting documentation is provided.

- Basic Life: Proof of Death Claim Form

- Accelerated Benefit: Accelerated Benefit Claim Form

- Accidental Death & Dismemberment (AD&D):

All claim forms and supporting documentation should be submitted directly to The Standard at the address listed on the form.

When Coverage Ends

Coverage ends when benefit eligibility ends, usually due to separation from IU employment or transferring to a non-eligible position. A covered Resident can convert or port the prior amount of insurance to an individual policy by completing the appropriate application below. Note: the group policy number is 135262-G.

Conversion or portability of coverage must be completed within 31 days after group coverage ends. For more information on continuing this benefit when coverage ends, review the Benefits After Separation guide.

Portability (Term Life)

The portability provision allows you to continue your group life policy as a personal term life policy. Term life insurance provides coverage for a specified amount of time (the “term”), typically 20–30 years. If you pass away during this term, your beneficiaries will receive a benefit payout from the policy. This provision also allows eligible Residents to continue AD&D coverage. Eligibility criteria and premium costs are noted in the Portability Application.

To apply for portable life insurance coverage, complete the following steps within 31 days of the date your group life coverage ends:

- Complete the Portability Application and return it to The Standard at the mailing address noted on application.

- IU Human Resources will submit the Employer Statement directly to The Standard; therefore, it does not need to be included in your mailing.

Conversion (Whole Life)

The conversion provision allows you to convert your policy to a whole life insurance policy, regardless of your state of health, as long as you apply within 31 days. Whole life provides continued protection with premiums payable to age 100. The policy accumulates cash value, and will allow you to borrow against the cash value, if sufficient. Interest on the policy loan will accrue daily and will be at a fixed rate (subject to policy terms and applicable state law). The policy does not share in dividends. Eligibility criteria and premium costs are noted within the Conversion Application.

To apply for whole life conversion insurance coverage, complete the following steps within 31 days of the date your group life coverage ends:

- Complete the Conversion Application and return it to The Standard at the mailing address noted on the application.

- IU Human Resources will submit the Employer Statement directly to The Standard; therefore, it does not need to be included in your mailing.

Questions

For assistance with your Group Life and AD&D benefits, please contact IU Human Resources at or 812-856-1234.